Claims

You can have the best risk management in place and

incidents still happen so that's why you have insurance.

Claims Submissions Assistance

Our trained staff understand your business operations and are well positioned, to discuss what is required to submit a claim. We help you get it right the first time.

Claims Preparing Made Easy

We can supply clients with risk management documents (waivers / incident reporting) and training so you know how to use them so it reduces the chance of an incident. You will be clear on the steps to you meet your insurance obligations.

Reducing Claims Consultancy

Preventing a claim is much better than having to submit one. Ask us for a review of your risk management policies and procedures so you have peace of mind.

What Your Policy Covers

Your coverage will be made up of the policy wording provided and a schedule of limits. Some policies will also have endorsements included. Make sure you read your insurance documents and ask us to explain any point you are unsure of.

BOOK CLAIMS CONSULTATIONS

We can assist you in preparing a claim submission in Business Packs, Public Liability, Personal Injury and other covers.

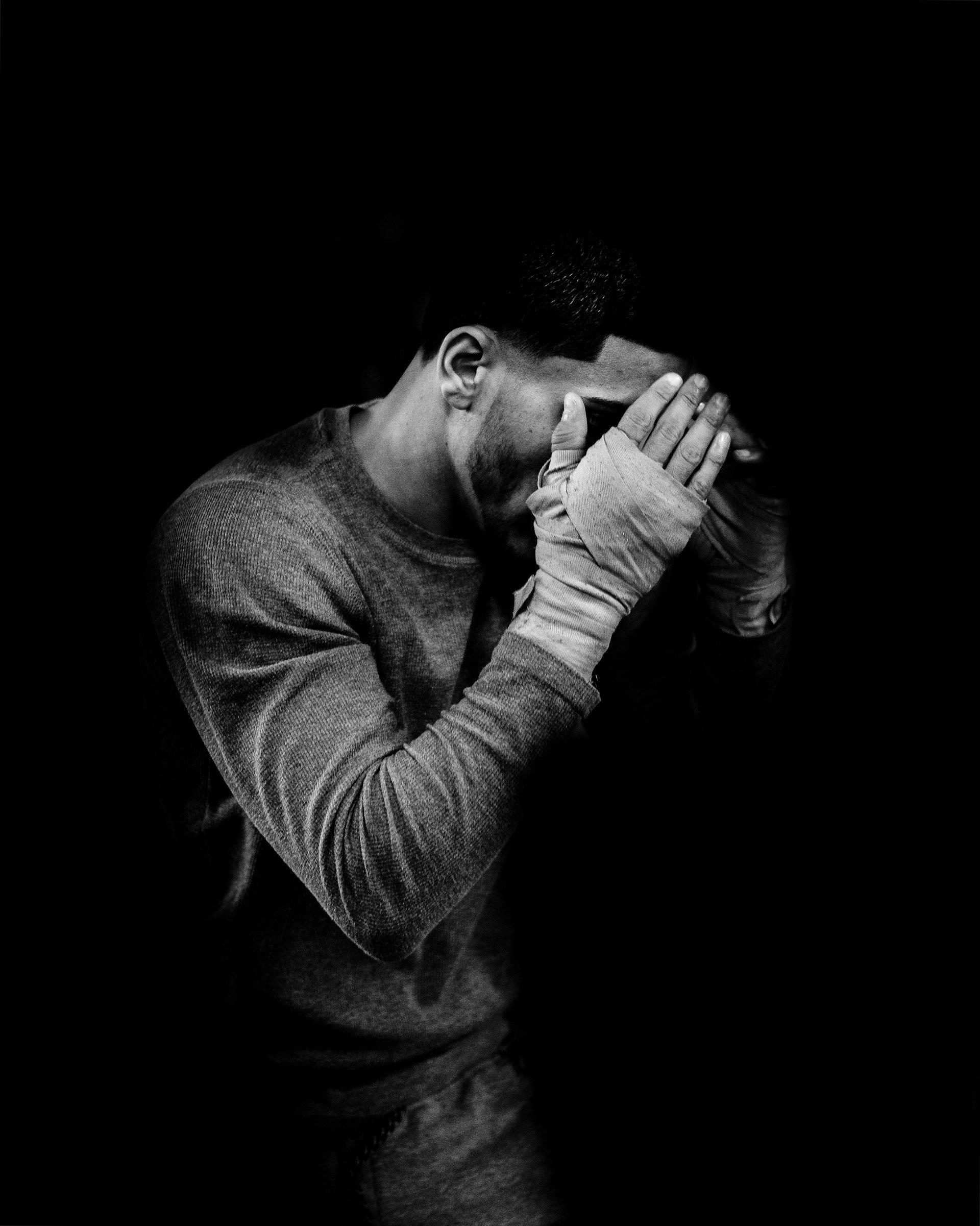

Does your standard gym policy cover your new kickboxing classes?

A standard policy may not cover kickboxing classes even if they are just for fitness and no sparring. This a grey area of cover with the activity having to be clearly defined. Don't risk it, we have a policy that we know covers it.

How can gym owners reduce their public liability insurance?

- Have a low claims ratio and/or have high level risk management policies.

- Have the highest qualifications for their instructors and constantly improve them

- Regularly do your own or get an independent risk assessors to review/audit your facility.

- Invest in more cameras to capture incidents, making it easier for insurers to defend against a claim.

- Ask their broker for a multi policy discount (purchase a biz pack or another policy)

- Find a broker with preferred rates (special program) where they pass on the rates to the client.

- Be with an association with special rates, through their broker, that gives members discounted rates

Are you sub-leasing some gym space for martial arts (eg: BJJ, Kickboxing, MMA)?

If so you will need to make sure they have their own insurance and they are qualified to teach. There can be complications of cover if your gym members join in the martial arts classes. Ask us what you should do.

Claims can put up your premium so why not jump brokers?

.Jumping brokers is not always the answer because you still have to disclose your claims history to any new insurer and they will quote based upon your historical risk. That said, your broker may suggest you ride out the increase premium for a couple of years until they drop again as you get better support if you have another claim. An experienced broker will know the market and unfortunately they are not a lot of players to chose from.

Why can some brokers get better rates for your gym and others can't?

- Brokers who belong to a buying group have greater volume and buying power to access better rates

- Some brokers only have access to a couple of insurers and not from the full market

- If you have had a few claims your premium maybe loaded or declined

- You may conduct activities that only a few insurers will cover reducing your options

What is a public liability claim against a business or the owner personally?

It is a letter of demand from an individual or more than one person, for an injury sustained or personal loss at your business. This type of claim is based upon the gym owner being negligent, therefore being liable. That said, irrespective of whether the gym owner is negligent or not, this has to be proven in court. The timeline of a claim like this may take 12-18months to finalise, but some actually go run for much longer.

What should you do if you have received a letter of demand from an injured member?

A claim maybe brought against a gym several months or more after an alleged incident so the manager needs to gather information to present to their broker.

- Check to see if the member was actually at the gym at the time of the alleged incident

- Check if the incident was reported and filed

- Check if there is any video footage and witnesses

- Collect all forms of communication with the injured member

- Do not admit fault

- Do not make any payments to the injured member

- Forward all information to your broker

- Have a low claims ratio and/or have high level risk management policies.

- Have the highest qualifications for their instructors and constantly improve them

- Regularly do your own or get an independent risk assessors to review/audit your facility.

- Invest in more cameras to capture incidents, making it easier for insurers to defend against a claim.

- Ask their broker for a multi policy discount (purchase a biz pack or another policy)

- Find a broker with preferred rates (special program) where they pass on the rates to the client.

What is the obligation of the insured to minimize the chance of a claim being successful brought against them?

- make sure the insured follows their operational procedures

- provide a safe and professional environment for members to train

- make sure all instructors / coaches at the gym are full qualified for what they teach

- make sure the gym has the appropriate risk management policies in place and they are followed

- every member or person participating in any activity at your gym, needs to sign a waiver

- every person trying out for the first time needs to be fully inducted into using the equipment safely

- equipment is regularly checked for correct operation and maintained to a safe standard

- make sure the facility is clean and there are no trip or slip hazards

What are some of the injuries that happen to gym members?

- tripping over a mat, weight, bag or over their own feet etc

- slipping on the soap in the shower, wet floor, wet mats from sweat

- lifting weights that are too heavy for the member

- free weights (bar bell) falling off as they didn’t clamp them securely

- free weights lying around and someone tripping over them

- falling off treadmills, bikes, steppers etc

- doing their own warm up unsupervised

- not doing an adequate warm up and working out too vigorously straight away

- not doing the exercise properly or showing off

- not listening or adhering to the instructor’s direction

- not looking where they are going and walked into walls, doors, equipment (on phone)

Ask us about our risk management strategies to help you minimize the chance of an incident.

Who are the people that claim on gym insurance?

- Those with a genuine claim due to negligence on the part of the operator and just want (reimbursement of costs)

- Those who take no responsibility for their actions and feel entitled to blame everyone else (go for max payouts)

- Those who take partial responsibility for their actions, but still feel entitled to claim (all their medical costs)

- Those who are opportunists who see an injury as an opportunity to scam the insurer (go for max payouts)

- Those who are professional scammers who fake injures and keep the claim under a certain threshold, as it’s more likely to be paid prior to going to court.

Ask us about our pre-claim strategies to help minimize the impact on your business.

WHAT IS SPARRING?

Some brokers may interpret sparring as hitting a bag / mitt and confidently saying their policy covers sparring. The facts are 'sparring' is when two or more people participate in a bout / fight under rules that may go from light contact to full power strikes to the body, head and legs on the mats, outdoors, in a ring or cage for example. Participation 'clauses' in martial arts training is when two or more people touch each other, whether lightly, firmly or with full power, this can be interpreted as 'sparring' which is not included in most covers. Warm up exercises and forms training without any partner drills is acceptable by more insurers. There is no need to compromise what you teach to fit into an insurance policy, when there are products that are fit for purpose.

EACH CLASS OF INSURANCE WILL HAVE A DIFFERENT CLAIM PROCESS

Letting Your Broker Know Of An Incident ASAP Is The Standard Protocol For The Insured

The information below is not any form of advise, it is what the insurer will expect an insured business to do, in the event of a claim.

Business Pack

Claim Process - Storm Damage

Put together a report of what has happened and assess the damage. Get quotes for repairs and provide purchase receipts for equipment that require repair or replacement. Take photos of the damage and don't dispose of any items you plan to claim, before the insurer has assessed them. Each provider will have a set of inclusions and limitations outline in your policy schedule. For business interruption you will need to provide financial reports to substantiate those losses.

Public Liability

Claim Process - Injured Member

This type of claim could be a 'slip & trip' scenario or from a coach directing a member to perform a certain move and getting injured. The injured party has to prove negligence on the part of the operator and this process may take more than 12 months to reach an outcome. Preparing an incident report is essential along with any video footage and witness statements.

Personal Injury

Claim Process - Injured Member

This type of claim may have come about the same as the public liability, but the injured party doesn't have to prove negligence. There will be a limit of benefits in the policy schedule. The same applies with preparing a report as the PL. It is important not to give the injured party an expectation of a result or hand over your insurance documents.